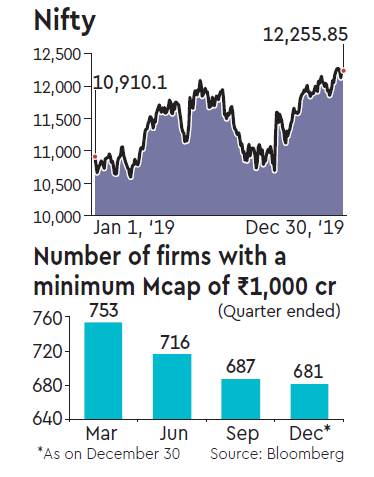

The benchmarks may have ended the year with double-digit returns, but nearly 80% listed companies on the BSE slipped in the red in 2019, as the intense polarisation of the markets continued. The two benchmark indices — Sensex and the Nifty — delivered 14.63% and 12.33% returns, respectively, but this bullishness is not reflected in portfolios as the market’s performance has been driven largely by the top 10 stocks. In fact, the mid and small cap indices have ended the year in the red too, as growth and earnings lagged pricey valuations.

The market’s polarisation has been progressively gaining momentum over the last few years, as corporate earnings continued to disappoint. Since 2014, the share of top 10 stocks in the overall market capitalisation of the listed universe has been steadily rising. In 2014, the share of top 10 stocks in the overall market cap was 14.4%, which has now risen to 23.4%.

Neelesh Surana, chief investment officer, Mirae Asset Global Investments, said, “While we have seen rally driven by a few stocks, wherever triggers are there stocks have performed well. Even in 2019 some of the value stocks participated in the rally like telecom and corporate sector banks. This only shows that whenever there are earnings, stocks will get re-rated. Correction in some of the stocks was also justified because of what happened in the system of credit crises and governance issues many of the casualties happened and they will not rebound.”

The sustained rally in quality stocks has been driven by capital flows, both domestic and global. In 2019, net investments by mutual funds in equities was $7.6 billion, against $14 billion invested by foreign portfolio investors. Domestic institutions also invested $6 billion in equities in 2019. Explaining this trend, UR Bhat, director at Dalton Capital Advisors, said, “As the process of institutionalisation of the market gathers momentum, it is the liquid large cap stocks that get the most attention from institutional investors. What has happened in 2019 is that many large foreign portfolio investors (FPIs), quite a few being new FPIs, have entered only in the top stocks in the Indian markets. Since a few large-cap stocks were becoming the toast of the market, even domestic players started investing in this space which led to the polarisation in the market”.

But this race for quality could moderate in the New Year, if some of the other sectors see some recovery. Gopal Agrawal, senior fund manager and head, macro strategy, DSP Mutual Fund, said: “Market rally is a function of earnings momentum and in last 18 months we saw earnings growth skewed towards few sectors and companies, add to this corporate tax benefit accruing immediately to consumer facing businesses. In next 12 months, we expect earnings recovery to be broad-based, which may lead to a broad-based rally as earnings decline in many businesses may come to an end”.

However, if recovery in sectors like auto, infrastructure and real estate does not play out then 2020 may not be very different from 2019, with the rally in a select stocks camouflaging the under-performance of the broader markets. In the last few days of the current calendar year, the laggards have started outperforming the benchmarks. Siddhartha Khemka, head – retail research, Motilal Oswal Financial Services, said, “Given reasonable valuations, midcaps and smallcaps have been outperforming largecaps for past few weeks. We expect this trend to continue in 2020. Investors are awaiting updates on the signing of a trade deal between the US and China, while keeping an eye on oil price which is currently at a three-month high”.

Mirae’s Surana also believes that despite slowing down of the economy, markets are holding on because of anticipation of earnings growth. “I think worst is over in terms of corporate earnings and we might see this polarisation in equity markets getting blurred going forward,” he adds.